UK Side Hustle Tax Calculator 2024/25

Overview

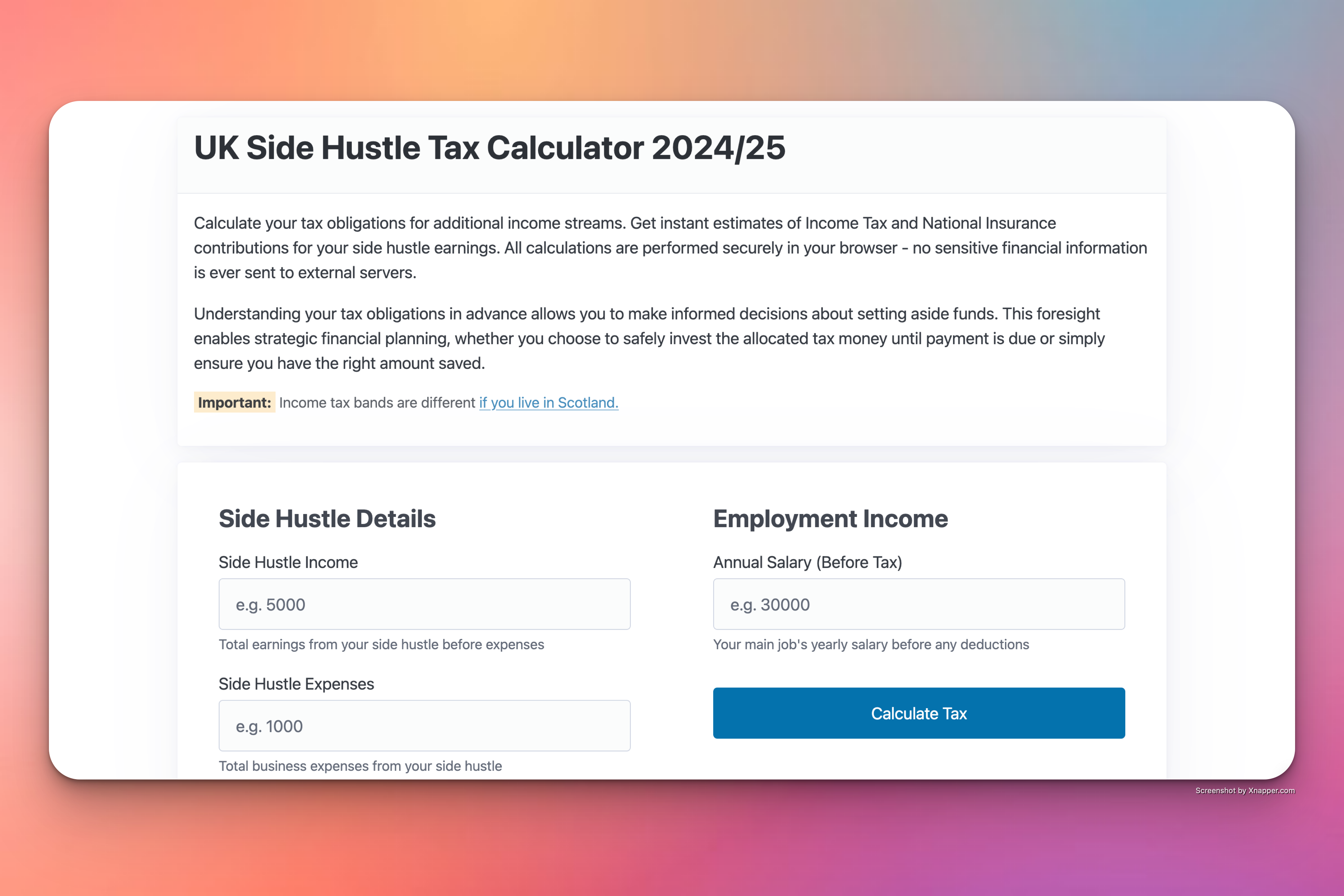

The UK Side Hustle Tax Calculator for 2024/25 provides instant estimates of your Income Tax and National Insurance contributions based on your side hustle earnings. Designed for individuals with additional income streams, the calculator ensures all computations are handled securely in your browser, keeping your financial data private.

Benefits

- Gain a clear understanding of your tax obligations for side hustle income.

- Plan your finances effectively by estimating the tax you need to set aside.

- Make informed decisions about investing or saving funds allocated for tax payments.

- Simplify tax management by understanding applicable rates and allowances.

Key Features

- Instant calculations based on UK tax rates for the 2024/25 financial year.

- Secure browser-based computation, with no data sent to external servers.

- Comprehensive breakdown of Income Tax and National Insurance contributions.

- Guidance on tax bands, allowances, and self-employment obligations.

Disclaimer

This calculator provides estimates only and does not constitute financial advice. For personalised guidance, consult HMRC or a qualified tax professional.

Note: Income tax bands differ for Scotland.